6y2.site

Learn

Loan To Pay Student Loan

Find out how to make your student loan payments on time while keeping the cost manageable. Learn about repayment programs, forgiveness plans, and more. Yes. The repayment is includible in the employee's gross income and in wages for Federal employment tax purposes, notwithstanding the agency's repayment of the. Standard Repayment – The borrower will pay a fix amount each month for the life of the loan. The payment would be determined by your borrowed amount, interest. Making extra payments toward your principal balance on your student loans can help you save money on interest and pay off your loan faster. If you want to make. And you can change your student loan repayment schedule at any time. If you have nonfederal loans, we may have options that will provide temporary relief. If you want to get out of student loan debt but aren't ready to fully pay off your loan, you can do it by paying a little extra each month. Making extra. MOHELA is part of Federal Student Aid's (FSA's) long-term servicing solution that will eventually allow you to fully manage your federal student loans on. Apply extra to the principal to pay off student loans fast. Remember that the interest on federal student loans accrues, or builds up, on a daily basis. So. Welcome to 6y2.site As your student loan servicer, we're here to make the repayment process as simple as possible. Find out how to make your student loan payments on time while keeping the cost manageable. Learn about repayment programs, forgiveness plans, and more. Yes. The repayment is includible in the employee's gross income and in wages for Federal employment tax purposes, notwithstanding the agency's repayment of the. Standard Repayment – The borrower will pay a fix amount each month for the life of the loan. The payment would be determined by your borrowed amount, interest. Making extra payments toward your principal balance on your student loans can help you save money on interest and pay off your loan faster. If you want to make. And you can change your student loan repayment schedule at any time. If you have nonfederal loans, we may have options that will provide temporary relief. If you want to get out of student loan debt but aren't ready to fully pay off your loan, you can do it by paying a little extra each month. Making extra. MOHELA is part of Federal Student Aid's (FSA's) long-term servicing solution that will eventually allow you to fully manage your federal student loans on. Apply extra to the principal to pay off student loans fast. Remember that the interest on federal student loans accrues, or builds up, on a daily basis. So. Welcome to 6y2.site As your student loan servicer, we're here to make the repayment process as simple as possible.

First we calculate the monthly payment for each of your respective loans individually, taking into account the loan amount, interest rate, loan term and. When Do Student Loan Payments Start? For recent graduates, payments typically start after a six-month grace period. This grace period still applies if you drop. What's going on with student loans? Learn about the latest on student loan forgiveness and how you can prep your finances for the repayment restart this year. A) $25 Monthly Payment Option: Assuming a $10, loan amount, a year term and a % APR, you would make 54 (48 months in school + 6-month grace period). A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan for the purpose of. In-School Payment Assistance lets you temporarily postpone your payments while in school and can help you avoid delinquency if you're struggling. The Graduated. Repayment Plans · Some repayment plans offer student loan repayment based on income. · A borrower may change repayment plans at any time. Loan Simulator. 5 ways to pay off your student loans faster · Get clear on what you owe · Increase your monthly payments if possible · Consider consolidating your debts. Sallie Mae® – Undergraduate Student Loans · Apply once to get money for the whole year. · Choose from multiple repayment options, including no payments while in. Aidvantage is here to help you better understand and manage repayment of your federal student loans. Log in to explore repayment options, manage your payments. ISAC urges you to remember to never pay for information about how to pay back your student loans, to learn about your repayment options through the resources. Although the student loan is not forgiven, agencies may make payments to the loan holder of up to a maximum of $10, for an employee in a calendar year and a. If you're facing financial hardship and find it difficult to make your private student loan payments, you might be able to apply for forbearanceOpens Dialog. Set up direct debit (aka autopay) for % off your interest rate. With direct debt, your payment is taken automatically from your bank account each month. All. Start by figuring out what you can pay. Private student loan lenders are not required to offer you any relief, so you may need to show proof. But reputable. You can alter your repayment length to help you either pay off your loans faster and save on interest or spread it out over more years to lower your monthly. The Minnesota Office of Higher Education is a cabinet-level state agency providing students with financial aid programs and information to help them gain. Repayment Options for Federal Student Loans · Standard Repayment Plan · Graduated Repayment Plan · Extended Repayment Plan · Income-Based Repayment (IBR) Plan. An IDR plan allows you to make payments based on your income and family size, ensuring you pay what you can afford. The Saving on a Valuable Education (SAVE).

Highest 0 Apr Credit Cards

0% intro APR on purchases and balance transfers for 15 months; % - % variable APR after that; balance transfer fee applies. Best 0% APR Credit Cards ; Citi Custom Cash® Card · Excellent, Good · Welcome offer ; Chase Freedom Unlimited® · Excellent, Good · Intro APR ; Capital One VentureOne. Why this is one of the best 0% introductory APR credit cards: The Wells Fargo Reflect card comes with a 0% intro APR for 21 months from account opening. After. To illustrate, the Citi® Diamond Preferred® Credit Card is one of the strongest 0% APR cards on the market, offering 12 months for purchases and 21 months for. 14 Best 0% interest credit cards of September · + Show Summary · Wells Fargo Reflect® Card · Capital One SavorOne Cash Rewards Credit Card · Discover. Some of the best credit cards in this category feature interest-free financing periods of 15 months or longer, while keeping annual fees and balance transfer. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. Some of the best 0% APR cards come with promotional periods of 15 months or more. Several such cards let you earn rewards or cash back. 0% Intro APR Credit Cards · Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card. 0% intro APR on purchases and balance transfers for 15 months; % - % variable APR after that; balance transfer fee applies. Best 0% APR Credit Cards ; Citi Custom Cash® Card · Excellent, Good · Welcome offer ; Chase Freedom Unlimited® · Excellent, Good · Intro APR ; Capital One VentureOne. Why this is one of the best 0% introductory APR credit cards: The Wells Fargo Reflect card comes with a 0% intro APR for 21 months from account opening. After. To illustrate, the Citi® Diamond Preferred® Credit Card is one of the strongest 0% APR cards on the market, offering 12 months for purchases and 21 months for. 14 Best 0% interest credit cards of September · + Show Summary · Wells Fargo Reflect® Card · Capital One SavorOne Cash Rewards Credit Card · Discover. Some of the best credit cards in this category feature interest-free financing periods of 15 months or longer, while keeping annual fees and balance transfer. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. Some of the best 0% APR cards come with promotional periods of 15 months or more. Several such cards let you earn rewards or cash back. 0% Intro APR Credit Cards · Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card.

These cards provide you with a 0% intro APR for a set period of time. Often this low intro APR can last for 12 months, but some credit card offers might. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. 0% introductory APR cards also have the potential to save you hundreds of dollars when you transfer debt with high interest rates. The best 0% APR cards offer. 0% intro APR credit cards ; Reflect® Card. Enjoy our lowest intro APR for 21 months ; Active Cash® Card. Earn unlimited 2% cash rewards on purchases ; Autograph. Prices are high. A rewards credit card, timed right and used strategically, can help you fight inflation. 6 min read Sep 05, NerdWallet's Best 0% APR Credit Cards of September · Wells Fargo Reflect® Card: Best for Longest 0% intro period · BankAmericard® credit card: Best for. 0% rate is automatic or depends on a credit check. The next step is determining which balances to transfer; cards with high interest rates should come first. Get 0% APR credit cards to help you with large purchases or unforeseen expenses. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Read our detailed reviews of the best zero-interest credit cards and make an informed choice that will best suit your personal needs. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June Take advantage of no interest payments. Get matched to intro 0% APR credit cards from our partners based on your unique credit profile. 0% Intro APR Credit Cards · Browse Our Card Categories · Citi Simplicity® Credit Card · Citi® Diamond Preferred® Credit Card · Citi Custom Cash® Card · Citi Rewards+. 0% intro APR credit card offers from our partners ; Chase · Chase Freedom Unlimited® · APR: 0% Intro APR on Purchases, Period: 15 months ; Citi · Citi® Diamond. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. 0% APR business credit cards allow small business owners to make essential purchases or pay down debt over time without accumulating interest. 7 Best 0% APR Credit Cards · Best Overall: Chase Slate EdgeSM Credit Card · Longest 0% APR Balance Transfer Promotion: Citi Simplicity® Card · Best Flat-Rate. Save on interest 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro APR for 15 months; % - % variable. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest.

Tooth Pain Killer Tablet

Take two mg pills of ibuprofen (total dose of mg) with one mg pill of acetaminophen. a.m.. p.m.. Day 2: Dose 1. Time. Take two mg pills of. Codeine: This option is available as a tablet, and people can take 15–60 mg every 4 hours as necessary, but it should not exceed mg in 24 hours. However. Drugs used to treat Toothache ; Generic name: ibuprofen systemic; Brand names: Advil Liqui-Gels, Advil Children's, Advil Infant's Concentrated Drops, Advil. Give your child anti-inflammatory medicines such as ibuprofen (Advil, Motrin) to reduce pain and swelling. Be safe with medicines. Read and follow all. Commonly prescribed opioid medications for relief of dental pain include hydrocodone, oxycodone, and acetaminophen with codeine. Using medications like ibuprofen (Advil, Motrin), acetaminophen (Tylenol), and aspirin can relieve minor pain from a toothache. Using numbing pastes or gels. For over 35+ years, Advil has been trusted on aches and pains like toothaches. Choose from a tablet, caplet, or gel cap, when used as directed. After dental surgery, it is common for a dentist to give patients a prescription (Rx) for tooth pain relief. Some of these medicines, such as Vicodin® or. medications found for 'toothache' · 7t gummy es mg chewable tablet · 8 hour pain relief · 8hr muscle ache-pain · a/f pain relief tablet · acephen mg. Take two mg pills of ibuprofen (total dose of mg) with one mg pill of acetaminophen. a.m.. p.m.. Day 2: Dose 1. Time. Take two mg pills of. Codeine: This option is available as a tablet, and people can take 15–60 mg every 4 hours as necessary, but it should not exceed mg in 24 hours. However. Drugs used to treat Toothache ; Generic name: ibuprofen systemic; Brand names: Advil Liqui-Gels, Advil Children's, Advil Infant's Concentrated Drops, Advil. Give your child anti-inflammatory medicines such as ibuprofen (Advil, Motrin) to reduce pain and swelling. Be safe with medicines. Read and follow all. Commonly prescribed opioid medications for relief of dental pain include hydrocodone, oxycodone, and acetaminophen with codeine. Using medications like ibuprofen (Advil, Motrin), acetaminophen (Tylenol), and aspirin can relieve minor pain from a toothache. Using numbing pastes or gels. For over 35+ years, Advil has been trusted on aches and pains like toothaches. Choose from a tablet, caplet, or gel cap, when used as directed. After dental surgery, it is common for a dentist to give patients a prescription (Rx) for tooth pain relief. Some of these medicines, such as Vicodin® or. medications found for 'toothache' · 7t gummy es mg chewable tablet · 8 hour pain relief · 8hr muscle ache-pain · a/f pain relief tablet · acephen mg.

Benzocaine is used short term to relieve pain from minor mouth problems (such as toothache, canker sores, sore gums/throat, mouth/gum injury). Available over the counter and a staple in most Americans' first aid kit, ibuprofen is considered most useful when treating mild to moderate tooth pain. Ibuprofen, aspirin, and acetaminophen are all effective pain killers—though one study suggests that ibuprofen is more effective against toothaches. Drugs used to treat Toothache ; Generic name: ibuprofen systemic; Brand names: Advil Liqui-Gels, Advil Children's, Advil Infant's Concentrated Drops, Advil. Ibuprofen, aspirin, and acetaminophen are all effective pain killers—though one study suggests that ibuprofen is more effective against toothaches. Oral Pain Reliever. When you're suffering from a toothache, a canker sore or another type of oral pain, your entire day can be impacted. · Tooth Pain Relief. 11 results ; Orajel 4x Medicated Severe Toothache and Gum Pain Cream - oz ; Orajel 3x Medicated Mouth Sores Gel - oz ; Wellements Organic Baby Tooth Oil -. Drug Facts ; Arnica Montana 30X HPUS. tooth pain, sensitive or swelling gums ; Calcarea Carbonica 12X HPUS. tooth pain, sensitive gums or teeth ; Calcarea. Ibuprofen works wonders on tooth aches. The reason you're feeling pain is from the amount of inflammation inside your tooth. mg every 6 hours. EXPAREL is an opioid-free pain medication that lasts for 72 hours and can be used to provide relief following wisdom tooth extractions, dental implant surgery. Many oral pain relief products including medicine for teeth pain use over-the-counter anesthetics as their key ingredients. These medications work by. Over-the-counter pain medicines such as ibuprofen (Advil) or naproxen (Aleve) are nonsteroidal anti-inflammatory drugs and are best taken on a schedule to. #1 Brand in Adult Oral Pain Relief · All Toothache & Denture · Severe Toothache Severe Toothache. Severe orajel-severe-toothache-and-gum-relief-plus-triple-. Recommended pain relief for dental pain in adults: Mild to moderate pain: mg paracetamol four times daily Or mg ibuprofen three times daily. The Dexibuprofen medication family, generally known as pain relievers, is made up of Nuprin Tablet. It relieves pain, inflammation, and swelling in disorders. Ibuprofen is a non-steroidal anti-inflammatory drug (NSAID) that is widely used to alleviate dental pain. It works by reducing inflammation, which is a major. Benzocaine (20%). Provides fast, temporary relief from severe toothache pain. It contains a high concentration of benzocaine, a local anesthetic. If you prefer the relief that pain medication can offer, choose between ibuprofen, naproxen sodium or acetaminophen and use one that works best for you. Consult. Oral pain medication Taking over-the-counter (OTC) pain medications, such as nonsteroidal anti-inflammatory drugs (NSAIDs), can be an effective wayTrusted. Medication for dental pain You may experience pain, irritation or discomfort with dental appliances like dentures or braces, or conditions like toothache or.

My W2 Went To The Wrong Address

4. The Name or Social Security Number is wrong on my W-2, what should I do? Your name and SSN must match the information on your Social Security Card. Send a. An incorrect or incomplete mailing address was on your return. · Your refund is being held because of a prior year tax liability. · You have filed for Bankruptcy. Call the IRS toll free at or make an appointment to visit an IRS taxpayer assistance center (TAC). The IRS will send your employer a letter. An incorrect or incomplete mailing address was on your return. · Your refund is being held because of a prior year tax liability. · You have filed for Bankruptcy. If you know you will be moving to a new address soon after you file your return, you should use that new address on your return. If you have moved or changed. Please update my address information per the information above. I certify that the foregoing information is true, correct and Mailing Address - Line 2. Employers must send W-2 forms by January What if my W-2 has the wrong address? If you've received your W-. We will correct the wages only on a W2-C and advise the employee that they will need to get the refund from the incorrect state and will most likely need to pay. M posts. Discover videos related to Where My W2 Not in Mailbox Went to Wrong Address Target Employee on TikTok. See more videos about Target Package. 4. The Name or Social Security Number is wrong on my W-2, what should I do? Your name and SSN must match the information on your Social Security Card. Send a. An incorrect or incomplete mailing address was on your return. · Your refund is being held because of a prior year tax liability. · You have filed for Bankruptcy. Call the IRS toll free at or make an appointment to visit an IRS taxpayer assistance center (TAC). The IRS will send your employer a letter. An incorrect or incomplete mailing address was on your return. · Your refund is being held because of a prior year tax liability. · You have filed for Bankruptcy. If you know you will be moving to a new address soon after you file your return, you should use that new address on your return. If you have moved or changed. Please update my address information per the information above. I certify that the foregoing information is true, correct and Mailing Address - Line 2. Employers must send W-2 forms by January What if my W-2 has the wrong address? If you've received your W-. We will correct the wages only on a W2-C and advise the employee that they will need to get the refund from the incorrect state and will most likely need to pay. M posts. Discover videos related to Where My W2 Not in Mailbox Went to Wrong Address Target Employee on TikTok. See more videos about Target Package.

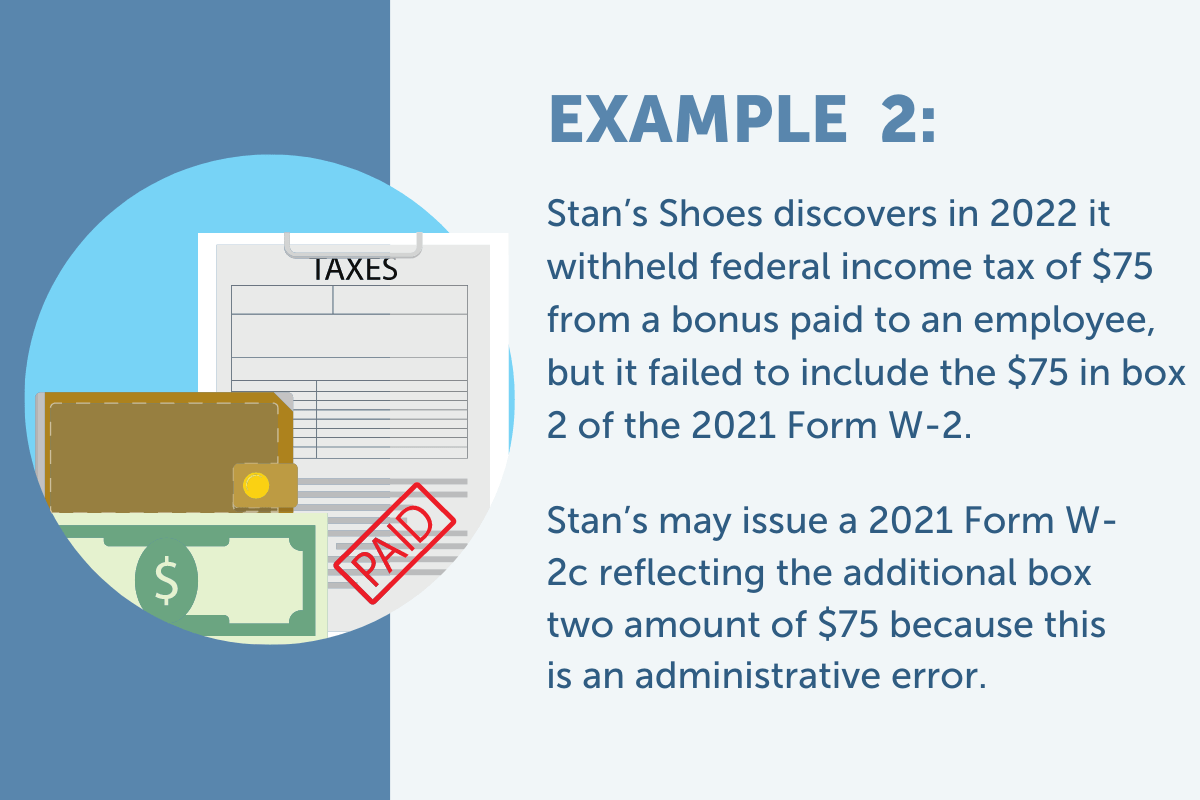

The address used on my W-2 is inaccurate. Does this need to be fixed before I can file my taxes? No. The Employee Home address is used for issuing Form W Payroll Services will mail a paper W-2 to you by the end of January, as required by the Internal Revenue Service. Update your mailing address in My ASU because. In addition, you will need to update your address with IRS using Form To change your information, you must include the following: Current address; New. What should I do if the address listed for me on my W-2 is incorrect? It is okay to submit a W-2 with your tax return in which the mailing address printed on. My former employer hasn't sent me my W-2 yet, and Paychex prepared my checks. How can I make sure you have my correct mailing address? Your W-2 will be. I think the amount on Line 1 of my G is wrong. How is that I think my G went to the wrong address. Can you send me another paper. My employer went out of business, or will not give me a W-2 form, what What should I do if my Form W-2 is incorrect? You should secure a corrected. What if my address is not correct on my W2? IRS will accept with incorrect address. Payroll uses the address on file to mail your document. USPS will not. If you do not have a Revenue Online account and you need to update your mailing address for the purpose of receiving a letter ID OR to change your legal name or. Therefore, you only need to update your address with Treasury if you moved between filings. Select Change My Address. Follow the prompts to update your. My former employer hasn't sent me my W-2 yet, and Paychex prepared my checks. How to get my W2. “How do I find my W-2 form?” is not an uncommon If the form was sent to the wrong address, ask them to resend it via email. If your return is filed electronically (using tax software), the system will automatically update the address. GTC. Logon to the Georgia Tax Center. Click on. You will be sent a letter that provides instructions and Form (PDF), Substitute for Form W-2, Wage and Tax Statement, or Form R, Distributions from. If it was mailed, it may have been returned to the employer because of an incorrect or incomplete address. After contacting the employer, allow a reasonable. If the address on your return is incorrect, you will need to contact the IRS to have it updated. You can call the IRS directly using their toll-free number: If it was mailed, it may have been returned to your employer because of an incorrect or incomplete address. If you do not receive your W-2 by February 15th, you. In addition, you will need to update your address with IRS using Form To change your information, you must include the following: Current address; New. The address used on my W-2 is inaccurate. Does this need to be fixed before I can file my taxes? No. The Employee Home address is used for issuing Form W A. Is the online W-2 available for separated employees? What should I do if the Social Security number, name or address is wrong on my W-2?

How To Make Your Parents Divorce

Be direct and clear, but be gentle. Your parents are going through a traumatic experience. It will be all too easy to upset them or make them angry, and then. your parents and the news of their divorce may make that need even greater. “When Mom told us they were divorcing she came clean about how bad their finances. Even though you want to leave, you can't just run away because your parents have legal authority over you. The wisest path is legal emancipation. your rights and get advice on helping your child That might be because one parent doesn't agree to attend the sessions, or because the parents can't make an. Did you feel shame over your parents' divorce?” When adult children know deep down that their father was emotionally abusive to their mother, why do they tend. But it's important to remember that it's not. Your parents are the ones who decided to get a divorce, and it's not your fault. It can be difficult to deal with. Book overview This companion to Speaking of Divorce is for kids ages 7– In a simple question-and-answer format, the book gently explains what divorce is. If possible, sit down with the other parent and plan how you're going to talk about what's going on. If you feel like you may get too upset or have trouble. It's essential for you to grasp the reasons behind your parents' decision to separate or get divorced but be aware that they might not be ready to go into. Be direct and clear, but be gentle. Your parents are going through a traumatic experience. It will be all too easy to upset them or make them angry, and then. your parents and the news of their divorce may make that need even greater. “When Mom told us they were divorcing she came clean about how bad their finances. Even though you want to leave, you can't just run away because your parents have legal authority over you. The wisest path is legal emancipation. your rights and get advice on helping your child That might be because one parent doesn't agree to attend the sessions, or because the parents can't make an. Did you feel shame over your parents' divorce?” When adult children know deep down that their father was emotionally abusive to their mother, why do they tend. But it's important to remember that it's not. Your parents are the ones who decided to get a divorce, and it's not your fault. It can be difficult to deal with. Book overview This companion to Speaking of Divorce is for kids ages 7– In a simple question-and-answer format, the book gently explains what divorce is. If possible, sit down with the other parent and plan how you're going to talk about what's going on. If you feel like you may get too upset or have trouble. It's essential for you to grasp the reasons behind your parents' decision to separate or get divorced but be aware that they might not be ready to go into.

See if you can set up a family meeting somehow. If your parents can't be in the same room together, plan to talk to one at a time then. Getting divorced doesn't. Your parents aren't talking to one another as much and rarely spend time together. Your parents begin to argue more often than usual. How Do Children React to Divorce? How Should a Parent Respond? An Outline Based on Maturity · Restore the child's confidence in himself and his world · Use your. It's often helpful for divorcing parents to come up with a plan and present it to their children together. And, keep the lines of communication open. Kids. Talk to them about how you feel emotionally. Talk to them about the practical side too - who is living where, what to do with your stuff, what. There are many reasons for divorce, and your parents have their own thoughts about why they needed to make this difficult and painful decision. But it's time to. divorced, because as a child, it was never anything I had to think about. Either I was very naive and/or my parents did an outstanding job of making. Here are a few ways you can best do this. 1. Help them uncork the pain. Pain is part of every divorce. But even if your friend's parents ended a toxic marriage. 1. Taking the blame. “My mom once told me that all the problems between her and my dad started when I was born, so I assumed that I was the reason my parents'. It helps if parents can figure out a way to make this work, especially because you may need to feel the support and presence of both parents even more during. The film stars Charlotte St-Martin as Justine, a preteen girl who is frustrated by the constant fighting of her parents Julie (Isabelle Blais) and Martin . I had doubts about my ability to make a marriage work. I feared ward members and friends would consider me spiritually inferior because of my family's problems. your browser. Abby Shares Her Experience with Her Parents' Divorce. Separation and divorce mean difficult transitions, but they can also be opportunities to. Talk to your children · If possible, you and the other parent should tell your children together about the divorce. · Children can handle many things, but do not. As An Adult, Navigating Your Parents' Divorce Is Complicated · 1. Communicate, then communicate some more. · 2. Make space for the grief. · 3. It is okay to. How can parents best protect their children from damaging conflict? What do evidence-based interventions for children and parents bring to our understanding of. Besides the health of your parents, you will also need to consider their finances. Assets get split in a divorce, so while your parents may have been. Dealing with Parents' Divorce · It is not your fault. · Talk to your parents. · Validate your feelings. · Find healthy ways to cope with stress and anxiety. · Know. Assure your children that both parents love them. · Do not argue in front of your children. · Make sure your children understand they did not cause the divorce. Going forward, focus on the love you have for each other and do things that are pleasant and bring out that love. Published 01/01/ NEXT STORY.

How To Choose A Lender

When shopping around, these are questions that can help you determine the best lender and loan product for you. It is important to get at least two lender referrals from your real estate agent and friends who have bought recently. Avoid going online, and do not disclose. Lenders are focused on four things when you apply for a loan: your credit scores, your monthly debt, your monthly income and how much money you've saved. best mortgage companies. How to Choose the Best Mortgage Lender? · Interest Rate · Fees · Customer Service · Flexibility in Terms and Conditions. The loan with the lowest mortgage rate may not always be the best choice for you. Rates are important, but you should also consider the overall cost of the loan. In this post, we'll explore the ins and outs of securing home financing—from choosing a reputable lender to finding a product that meets your needs. 3 tips on finding the right lender · #1: Talk to friends and family · #2: Ask your bank or local credit union · #3: Tap into Gravy's curated lender network. Your choice between A-Lenders and B-Lenders should be based on your financial situation and how much risk you're willing to take. A-Lenders could offer you the. Many people assume you should go straight for the mortgage lender that offers you the best rate, but there are many other factors to consider. When shopping around, these are questions that can help you determine the best lender and loan product for you. It is important to get at least two lender referrals from your real estate agent and friends who have bought recently. Avoid going online, and do not disclose. Lenders are focused on four things when you apply for a loan: your credit scores, your monthly debt, your monthly income and how much money you've saved. best mortgage companies. How to Choose the Best Mortgage Lender? · Interest Rate · Fees · Customer Service · Flexibility in Terms and Conditions. The loan with the lowest mortgage rate may not always be the best choice for you. Rates are important, but you should also consider the overall cost of the loan. In this post, we'll explore the ins and outs of securing home financing—from choosing a reputable lender to finding a product that meets your needs. 3 tips on finding the right lender · #1: Talk to friends and family · #2: Ask your bank or local credit union · #3: Tap into Gravy's curated lender network. Your choice between A-Lenders and B-Lenders should be based on your financial situation and how much risk you're willing to take. A-Lenders could offer you the. Many people assume you should go straight for the mortgage lender that offers you the best rate, but there are many other factors to consider.

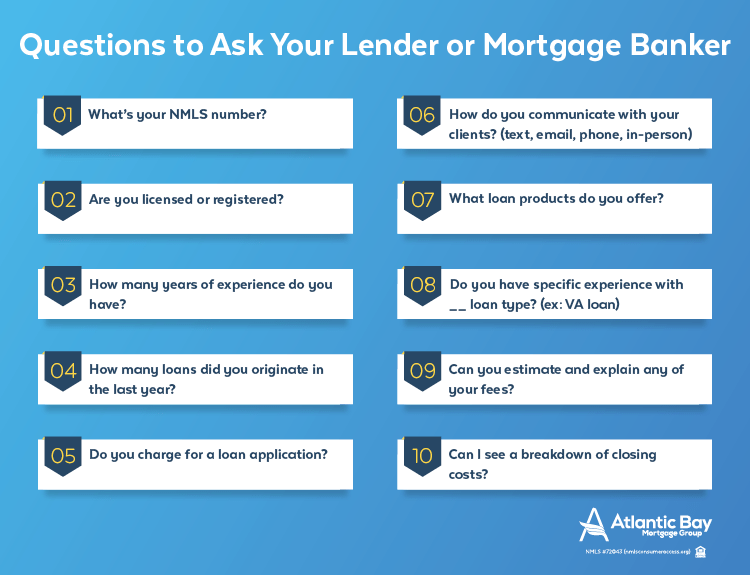

Here are a few expert tips to help you find the best mortgage lender and prepare for the future. Choosing a mortgage lender relationship should be just as important as finding the perfect home since you will likely hold a mortgage for years to come. Whether. It is important to get at least two lender referrals from your real estate agent and friends who have bought recently. Avoid going online, and do not disclose. Mortgage Lenders Vary. The first thing to know is that there are a variety of lenders willing to provide you a home loan and the services they offer will vary. Lenders are focused on four things when you apply for a loan: your credit scores, your monthly debt, your monthly income and how much money you've saved. Look for lenders with a strong reputation, positive reviews, and competitive interest rates. Compare the services offered by each lender, including the types of. Usually, mortgage lenders are very competitive, and they all provide the same bag of cash. One of the criteria that can help you choose the best mortgage lender. The best mortgage lenders, like Regions Bank, offer three indispensable traits to homebuyers: stability, deep industry knowledge and personal service. These. Many people assume you should go straight for the mortgage lender that offers you the best rate, but there are many other factors to consider. We've listed five key things you may want to consider when shopping for a mortgage lender. 1. Does the lender offer competitive interest rates? Comparing lenders is how you find the best rate and terms for your home loan needs," says Chris Allard, lead mortgage broker at Chris Allard Mortgage Team. Local lenders have a much better understanding of the local market, are able to make decisions locally, offer personalized service, and typically have access. Below are some questions you will want to ask, to make the best choice in choosing your residential or commercial lender or mortgage originator. It pays to shop around and talk to at least three lenders to get a sense of the person, the interest rates, and the specifics of the loan they can provide you. Here are your keys for making a smart, educated choice when it comes to choosing a mortgage lender. There are a lot of mortgage lenders out there, and most homebuyers request quotes from at least three before choosing one to work with. If you are looking to finance equipment for your business, your primary options are depository lenders, such as banks, and independent lenders like Team. How to Choose the Right Mortgage Lender When Buying Atlanta Homes · Make Sure Your Credit Is in Good Shape · Understand Your Lending Options · Apply for Pre-. Credit unions are a leading choice when picking a mortgage lender, because they offer a wide variety of loans, lower fees, and more flexible terms than. Get the interest rates on the different loans each lender offers. Make yourself a chart to compare the interest rates and mortgage terms. Check to see who will.

Best Motherboard For Mining 2021

Best motherboard for AMD Ryzen 9 X. By Cale Hunt published August 6, I've collected the best boards using the XE chipset right here. ASUS mining motherboard features 19 PCI Express® (PCIe®) slots. With 18 PCIe x1 and one PCIe x16 slots on board, plus three zoned ATX12V power connectors. Model: BXKF, Best Price: $, Release date: November - Core i9 12th Gen, Alder Lake, LGA, None, MHz, MHz. The bill of materials · Gigabyte GA-AM motherboard ($) · Rosewill SRMB case ($) · Oloy 8GB RAM stick ($) · SEKC GB M2 Solid. Bigger and Better · New Motherboard — MSI ZA-PRO LGA (~$) — Capable of supporting up to 7 GPU's (6 via PCIe slots and 1 via M2 slot). What are the recommended GPU settings for mining cryptocurrencies on an ASUS motherboard with BIOS? avatar john girgis. Aug 04, · 3 years ago3 answers. October 20, , PM. #1. ASRock B PRO4 R, Is there any motherboard that's better than B? Maybe it's because this is the only. The place to shop for software, hardware and services from IBM and our providers. Browse by technologies, business needs and services. The ASRock H PRO is a good motherboard for mining because it is one of the few motherboards that support both AMD and NVIDIA GPUs. The. Best motherboard for AMD Ryzen 9 X. By Cale Hunt published August 6, I've collected the best boards using the XE chipset right here. ASUS mining motherboard features 19 PCI Express® (PCIe®) slots. With 18 PCIe x1 and one PCIe x16 slots on board, plus three zoned ATX12V power connectors. Model: BXKF, Best Price: $, Release date: November - Core i9 12th Gen, Alder Lake, LGA, None, MHz, MHz. The bill of materials · Gigabyte GA-AM motherboard ($) · Rosewill SRMB case ($) · Oloy 8GB RAM stick ($) · SEKC GB M2 Solid. Bigger and Better · New Motherboard — MSI ZA-PRO LGA (~$) — Capable of supporting up to 7 GPU's (6 via PCIe slots and 1 via M2 slot). What are the recommended GPU settings for mining cryptocurrencies on an ASUS motherboard with BIOS? avatar john girgis. Aug 04, · 3 years ago3 answers. October 20, , PM. #1. ASRock B PRO4 R, Is there any motherboard that's better than B? Maybe it's because this is the only. The place to shop for software, hardware and services from IBM and our providers. Browse by technologies, business needs and services. The ASRock H PRO is a good motherboard for mining because it is one of the few motherboards that support both AMD and NVIDIA GPUs. The.

Other non-graphical uses include the training of neural networks and cryptocurrency mining IGPs can be integrated onto a motherboard as part of its. Another "Time to upgrade" - vs and motherboards. Dec 4, Its time to upgrade the 6-year- The last motherboard that i bought was a $50 ". What are the best BIOS settings for mining cryptocurrencies on the Gigabyte Z Gaming 7 motherboard? avatar Megha Kt. Aug 24, · 3 years ago3 answers. Another "Time to upgrade" - vs and motherboards. Dec 4, Its time to upgrade the 6-year- The last motherboard that i bought was a $50 ". The ASRock H Pro BTC+ motherboard for mining is present in the 1st position in this list since this is the perfect option for building highly powerful mining. Other non-graphical uses include the training of neural networks and cryptocurrency mining IGPs can be integrated onto a motherboard as part of its. Next we are going to Need a Motherboard for these CPUs now most x, B, X, and Bs will work depending how you wish to overlock your CPU I recommend. The ASRock H PRO is a good motherboard for mining because it is one of the few motherboards that support both AMD and NVIDIA GPUs. The. Find helpful customer reviews and review ratings for ASRock H Pro BTC+ 13GPU Mining Motherboard Cryptocurrency at 6y2.site Read honest and unbiased. 6 Pin 12 PCI-E Port Mining Breakout Board for Power Supply Module Miner Eth Zec Server Power 12V Power Supply Board · 6 Pin 60cm USB3. · Newest Vers Plus. Buy ASRock H Pro BTC+ 13GPU Mining Motherboard Cryptocurrency: Motherboards - 6y2.site ✓ FREE DELIVERY possible on eligible purchases. One of the most common setups is a GPU mining rig, which is usually a frame and a motherboard with 6 – 12 GPU cards plugged into it. Some passionate GPU miners. In , $15 billion in revenue was made by Bitcoin miners according to research by The Block. Mining can be a very profitable endeavor, even for (non-technical). best price/performance ratio for this task. The price of a Pi 4 + PCIe riser + PCIe expander is close to the price of a mining motherboard, a cheap CPU and. ASUS B Mining Expert Power Kit. For the Mboard + GPU's - Parallel Miner |. Find helpful customer reviews and review ratings for ASRock H Pro BTC+ 13GPU Mining Motherboard Cryptocurrency at 6y2.site Read honest and unbiased. Reliability, performance, and cutting-edge technology make the new TZBTC DUO motherboard list out as one of the best choices for mining. Updated 13Feb GPU mining requires at least the following hardware: A motherboard, CPU, RAM, hard drive, a power supply, an operating system. Products damaged during crypto mining operations. Except where prohibited If a hardware replacement is required, Corsair will make a best effort to. computer and mining software compatible with Bitcoin software and join a mining pool. , trading at a record high of $69, in November It.

Which Is Better State Farm Or Progressive

State Farm is No. 1 in our rating of the best and cheapest renters insurance companies. State Farm's base rate is $ per month, while Progressive's is. With State Farm, zero issues with getting coverage. Price will depend on a number of things, including your state so best to get quotes from multiple companies. Go ahead and switch to Progressive, but raise your liability limits to // if your a normal person or // if your well-to-do. State Farm is by far the largest insurer in Ohio in the homeowner and auto markets. State Farm collects five times more HO premiums than its next closest. Progressive is generally cheaper than State Farm with an average rate of $ per month. State Farm, however, isn't much more expensive, coming in at $ per. Progressive is better than Farmers overall, per WalletHub's grading criteria. Farmers wins out over Progressive in terms of discounts offered. State Farm's rates are cheapest for the average driver, and it's more affordable than Progressive in 36 states. Progressive is less expensive in 12 states. If you feel another agent could better serve your needs, we've got you covered. You can make the switch online, by email, or mail. With over 18, agents. Both of these companies are outstanding insurers. Progressive gets an A+ rating by AM BEST, State Farm gets an A++ rating, you cannot go wrong with either of. State Farm is No. 1 in our rating of the best and cheapest renters insurance companies. State Farm's base rate is $ per month, while Progressive's is. With State Farm, zero issues with getting coverage. Price will depend on a number of things, including your state so best to get quotes from multiple companies. Go ahead and switch to Progressive, but raise your liability limits to // if your a normal person or // if your well-to-do. State Farm is by far the largest insurer in Ohio in the homeowner and auto markets. State Farm collects five times more HO premiums than its next closest. Progressive is generally cheaper than State Farm with an average rate of $ per month. State Farm, however, isn't much more expensive, coming in at $ per. Progressive is better than Farmers overall, per WalletHub's grading criteria. Farmers wins out over Progressive in terms of discounts offered. State Farm's rates are cheapest for the average driver, and it's more affordable than Progressive in 36 states. Progressive is less expensive in 12 states. If you feel another agent could better serve your needs, we've got you covered. You can make the switch online, by email, or mail. With over 18, agents. Both of these companies are outstanding insurers. Progressive gets an A+ rating by AM BEST, State Farm gets an A++ rating, you cannot go wrong with either of.

On average, Progressive offers more affordable liability auto insurance policies, at $79 per month compared to Farmers' $ monthly average. However, this. The Better Business Bureau gives Progressive an A. Auto insurance State Farm, $1,,,, %. 9, W.R. Berkley Corp. $1,,,, %. Progressive is not some cheap discount insurance company. They are every bit as 1st rate as State Farm. They may not be quite as big as State. State Farm is our No. 3 pick of the best car insurance companies, while Progressive ranks No. · Progressive offers cheaper rates for drivers with bad credit. State Farm is better than Progressive overall, per WalletHub's grading criteria. State Farm beats Progressive when it comes to customer reviews. State Farm is better than Progressive overall, per WalletHub's grading criteria. State Farm beats Progressive when it comes to customer reviews. State Farm is the nation's largest car insurance company. It also has the cheapest rates for most drivers. Progressive, Geico and Allstate are next-largest. Is State Farm better than Progressive? In general, State Farm is cheaper than Progressive. On the one side, Progressive provides multiple coverage forms that. Save up to 30% on your car insurance with a Drive Safe & Save® discount at State Farm. Save up to 10% just for signing up. Enroll today. Known for its robust customer service and extensive network of agents, State Farm is a solid choice for those who prefer a more personalized approach to their. Progressive is more expensive than State Farm based on average car insurance rates since State Farm's rates are lower. However, your car insurance company is. Get a comparison of working at Progressive vs State Farm. Compare ratings, reviews, salaries and work-life balance to make the right decision for your. Farm Bureau's average premiums decrease almost 25% during that same period. Which is the Best Company for Retired Drivers? Farm Bureau, Progressive. 65+-year-. While Progressive insures more drivers than Farmers Insurance, both are major insurance companies and among the most popular in the country. While Progressive insures more drivers than Farmers Insurance, both are major insurance companies and among the most popular in the country. The Better Business Bureau (BBB) offers a lot of useful information on many major companies throughout the United States, including car insurance companies. Progressive is on par with companies like Allstate and State Farm and fared better than Liberty Mutual which had several 2-circle ratings. Read more. Progressive offers plenty of incentives to help drivers in Washington get the best car insurance. Our auto insurance customers earn an average of seven. Progressive and Farmers both offer plenty of coverage, but if we compare the two insurers, Progressive has more coverage options than Farmers. Progressive has. State Farm, Geico, and Progressive take our top spots for the best auto insurance companies because they offer diverse coverage options, low rates, and solid.

Does Upgrade Card Help Build Credit

Yes, Upgrade launched in and is a legitimate service. Besides personal loans and the Upgrade Card, it offers borrowers access to free credit monitoring. We report to all 3 credit bureaus to help you build credit over time. Members see an increase of 30 points on average5. 4 / 4. Member testimonials. “My goal is. Yes, the Upgrade Secured OneCard is designed to help customers build credit responsibly by using a secured deposit to set the card's credit limit. Payment. Grow Credit builds credit factors that make up 90% of your FICO Score4No hard credit inquiry required. 35%. Payment History. Make on-time payments in full every. It's a new account to make on-time, in-full payments (the number one factor of your credit score). It also is another line of credit. As long as you don't start. No Annual Fee. · Take control and help rebuild your credit. · Request your own credit limit by providing a single deposit between $ and $5, (multiples of. Does the Upgrade Card help build credit? Yes, the card can help you gradually raise your credit score with responsible use. On time payments are reported to. If you have fair credit, Upgrade could be a strong personal loan option, particularly if you're looking to consolidate debt or refinance a credit card. Yes, Upgrade launched in and is a legitimate service. Besides personal loans and the Upgrade Card, it offers borrowers access to free credit monitoring. Yes, Upgrade launched in and is a legitimate service. Besides personal loans and the Upgrade Card, it offers borrowers access to free credit monitoring. We report to all 3 credit bureaus to help you build credit over time. Members see an increase of 30 points on average5. 4 / 4. Member testimonials. “My goal is. Yes, the Upgrade Secured OneCard is designed to help customers build credit responsibly by using a secured deposit to set the card's credit limit. Payment. Grow Credit builds credit factors that make up 90% of your FICO Score4No hard credit inquiry required. 35%. Payment History. Make on-time payments in full every. It's a new account to make on-time, in-full payments (the number one factor of your credit score). It also is another line of credit. As long as you don't start. No Annual Fee. · Take control and help rebuild your credit. · Request your own credit limit by providing a single deposit between $ and $5, (multiples of. Does the Upgrade Card help build credit? Yes, the card can help you gradually raise your credit score with responsible use. On time payments are reported to. If you have fair credit, Upgrade could be a strong personal loan option, particularly if you're looking to consolidate debt or refinance a credit card. Yes, Upgrade launched in and is a legitimate service. Besides personal loans and the Upgrade Card, it offers borrowers access to free credit monitoring.

The Discover it® Secured Card can help you build credit with responsible use2, like making your payments on time and in full each month. Payment history is. A secured card packed with features to help you on your credit journey: ; Build credit history. Important account information is shared with the three major. With responsible card use, you could earn back your deposit and upgrade to a standard, unsecured Platinum card. 1. No Hidden Fees. No foreign transaction. A higher credit limit can even boost your credit score. In fact, there are at least six reasons why it can be good to increase your credit limit. Key Takeaways. Get a co-signer. How does it work? Instead of applying for a credit card or a loan on your own, you apply with a co-signer who essentially uses their. Deposit at least $ (up to $5,) into your membership savings account. · Submit your application. · After just 3 months, you could be eligible for a credit. Credit cards to help build or rebuild credit can create a successful financial future when handled responsibly. See more. Enhanced Credit Limit: When you upgrade your Credit Card, there is a chance to increase in the overall credit limit or even get a Credit Card upgrade depending. Apply for a secured Credit Builder Credit Card, a product designed to help establish or rebuild credit. · Deposit an amount from $ up to $3, into a Credit. The Upgrade Cash Rewards Visa® is a cost-effective credit card option if you have fair credit and want to build credit. No i would not advise doing this, reasons being: 1. loss in terms of overall credit history→when you upgrade a credit card, the older card. The credit card offers on this page are geared toward individuals looking to build or rebuild credit. If you are one hundred percent committed to making on-time. ̍Step Visa Card is designed to help build positive credit history. Positive history is reported on and related only to your Step Visa card activity. We report to all 3 credit bureaus to help you build credit over time. Members see an increase of 30 points on average5. 4 / 4. Member testimonials. “My goal is. The Upgrade Triple Cash Rewards card is geared to consumers with fair or better credit (or a FICO score of at least ), so be sure to check your credit score. They come with bigger restrictions than regular credit cards, but with responsible use they can help you build up your credit. Chase Sapphire is an official. In addition, a secured OneCard is designed to help customers build credit responsibly by using a secured deposit to set the card's credit limit. Payment. This is a game changer of a service. The fact that I can use my own money to boost my credit score is amazing. If that wasn't enough the customer service is top. Use of the Key Secured Credit Card can help build your credit when the minimum payment is made by the due date, each month. 2. Please see the cardmember.

Balance Transfer 0 Interest For 24 Months

Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. Enjoy 0% interest period on balance transfers for up to 27 months with the Balance Transfer Credit Card from Tesco Bank. Find out more and apply today! Citi® Diamond Preferred® Card: Best feature: month 0% introductory rate on balance transfers. Citi Rewards+® Card: Best feature: Two points per dollar spent. Barclaycard up to 18 month balance transfer and up to 21 month purchase Platinum card (a transfer fee applies) · 0% interest on purchases, for up to 21 months. See Rates & Fees. Balance transfer intro APR. 0% intro APR for 21 months from account opening on qualifying balance transfers. Regular APR. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, %, %, %, % or % variable APR based. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Longest 0% Intro APR Cards for Balance Transfers · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card * · Citi Simplicity® Card * · U.S. Bank Visa® Platinum. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. Enjoy 0% interest period on balance transfers for up to 27 months with the Balance Transfer Credit Card from Tesco Bank. Find out more and apply today! Citi® Diamond Preferred® Card: Best feature: month 0% introductory rate on balance transfers. Citi Rewards+® Card: Best feature: Two points per dollar spent. Barclaycard up to 18 month balance transfer and up to 21 month purchase Platinum card (a transfer fee applies) · 0% interest on purchases, for up to 21 months. See Rates & Fees. Balance transfer intro APR. 0% intro APR for 21 months from account opening on qualifying balance transfers. Regular APR. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, %, %, %, % or % variable APR based. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Longest 0% Intro APR Cards for Balance Transfers · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card * · Citi Simplicity® Card * · U.S. Bank Visa® Platinum. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that.

Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer. So you may have almost. At that rate, carrying that balance and paying $ a month would require 24 months to pay off and cost $1, in interest. After securing a month 0% balance. Balance transfer cards typically offer a 0% interest rate for a set period, which may last up to 30 months. You may be able to reduce the amount you're. Our Longer Balance Transfer Card offers 0% interest on balance transfers for 23 months, with a % balance transfer fee. You'll also benefit from 0% on. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. There aren't any credit cards that offer a 0% APR on balance transfers for 24 months right now. However, the Citi Simplicity® Card gives the next best thing. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. If you transfer a balance with this offer, interest will be charged on purchases made with your credit card unless your purchases have a 0% APR or you pay the. 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - % based on your creditworthiness. Oldest account age: e.g. 5 years 6 months. Chase 5/24 status: e.g 2/24 Some 0% BT Fee & 0% Interest Balance Transfer credit cards may still be. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. 0% intro APRFor a limited time, get a special 0% intro APR* on purchases and balance transfers† for 21 billing cycles. · $0 Annual FeeEnjoy great benefits with. From time to time, some banks offer a 0% or low-interest deal for 6 to 12 months, offering relief to those battling credit card or store card debt. You can't. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. 3% Intro Balance Transfer. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the.