6y2.site

Overview

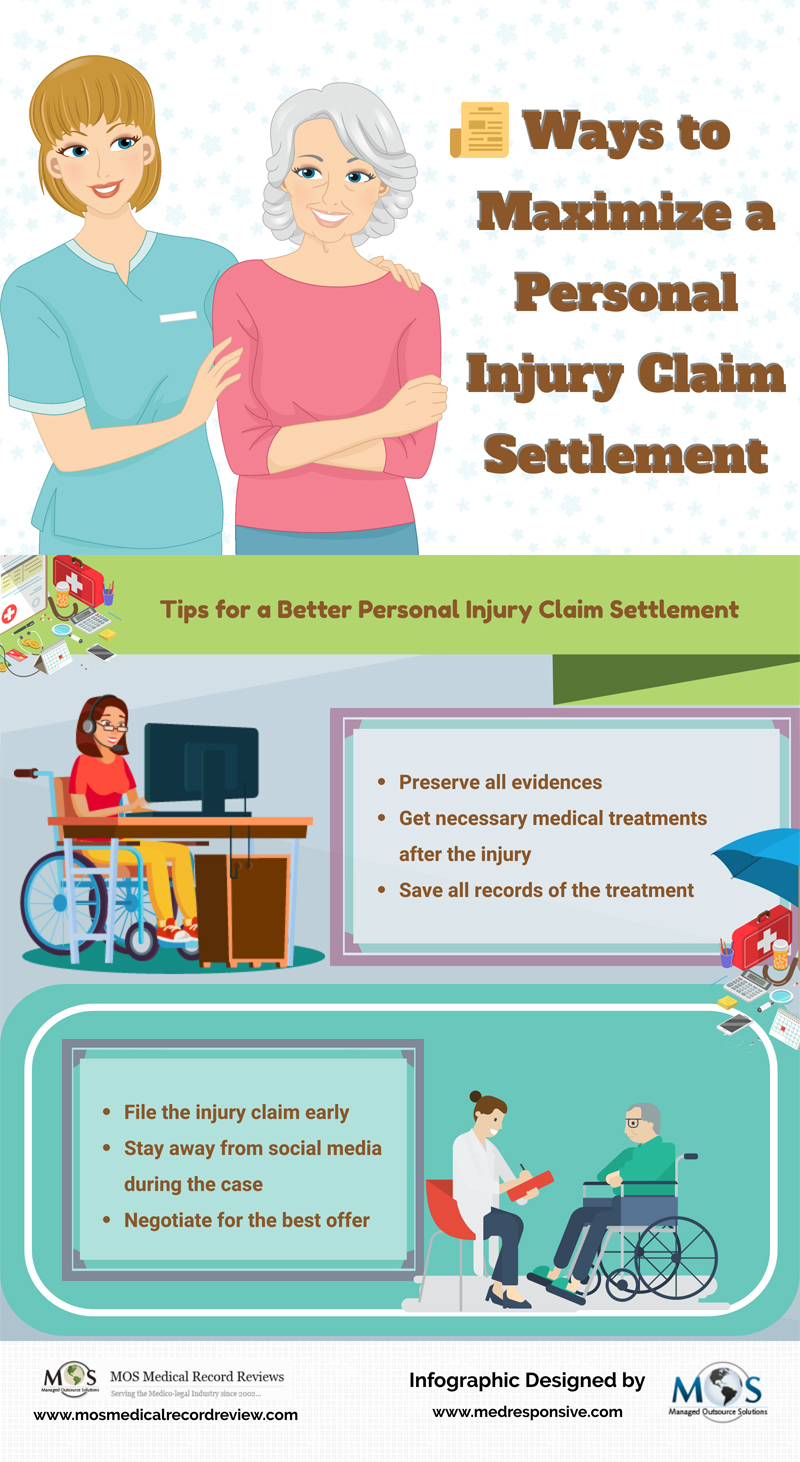

Settlement Of Personal Injury Claims

Your lawyer will give you a written invoice, which includes the settlement amount minus liens and legal fees such as attorney's fees and contingency fees. Once. However, if you allow a personal injury attorney to negotiate an appropriate settlement, you can get an average of $42, Is My Claim Worth Three Times my. The median payout for a personal injury lawsuit is approximately $52, For most victims with moderate injuries, like broken bones, sprains, and whiplash. Court rulings are public record, which means any decision the court makes about your settlement will become public record if you go to trial. Generally, you and your personal injury lawyer will use the damages formula to determine a starting point for the settlement process. A personal injury settlement can be paid out in a number of different ways depending on the specific facts of the case. Are Personal Injury Settlements Taxed? No, your personal injury claim compensation is generally not taxable by the IRS or your state. Whether your case went. How Much Compensation Is Typical in Personal Injury Cases? More than half of the readers in our survey received payouts ranging from $3, to $25, The amount you can receive in a settlement varies depending on the severity of your injuries, but there are some factors that will influence the offer made by. Your lawyer will give you a written invoice, which includes the settlement amount minus liens and legal fees such as attorney's fees and contingency fees. Once. However, if you allow a personal injury attorney to negotiate an appropriate settlement, you can get an average of $42, Is My Claim Worth Three Times my. The median payout for a personal injury lawsuit is approximately $52, For most victims with moderate injuries, like broken bones, sprains, and whiplash. Court rulings are public record, which means any decision the court makes about your settlement will become public record if you go to trial. Generally, you and your personal injury lawyer will use the damages formula to determine a starting point for the settlement process. A personal injury settlement can be paid out in a number of different ways depending on the specific facts of the case. Are Personal Injury Settlements Taxed? No, your personal injury claim compensation is generally not taxable by the IRS or your state. Whether your case went. How Much Compensation Is Typical in Personal Injury Cases? More than half of the readers in our survey received payouts ranging from $3, to $25, The amount you can receive in a settlement varies depending on the severity of your injuries, but there are some factors that will influence the offer made by.

Settlement Negotiations: The insurance company may deny your claim, accept liability or respond to the demand letter with a counter-offer. Settlement. While most personal injury cases tend to settle on an amount anywhere from 3, dollars to 75, dollars, what you need to know is that settlements vary based. The median payout for a personal injury lawsuit is approximately $52, For most victims with moderate injuries, like broken bones, sprains, and whiplash. The typical contingency fee is one-third of your compensation, or 40% if the case goes to trial. Case Expenses. Your lawyer may have paid expenses for items. Personal injury claims rely on negligence. For a victim to be eligible for compensation, they must be able to prove that the other involved party was negligent. Here are some key questions to consider on personal injury settlements, such as the damages you can collect and how personal injury lawyers get paid. Suppose you're considering settling a car accident claim after an accident or injury or getting a settlement offer. You may want to talk to a personal injury. In basic terms, a cause of action is a reason that the law recognizes that allows someone to seek compensation for injuries and harms. This gives the. How Are Personal Injury Settlements Distributed? · Attorney's fees pay your attorney and their paralegals for the work they have done on your case. · Medical. It generally takes years to reach a settlement or receive a verdict in a personal injury case. The process of settlement of a personal injury claim refers to when you and the person who caused you injuries agree to reach a voluntary resolution of your. Sometimes an investigation cannot be completed in that timeframe and the Comptroller's Office cannot offer settlement. In order to pursue your claim, you must. The nationwide median jury award in a personal injury lawsuit is approximately $40, The plaintiffs won 48% of jury trials. The average payout for a personal. The most frequent settlement option is the lump sum payment. If you accept a lump sum settlement, the remaining funds are paid once after deducting legal fees. When estimating how much an injury claim is worth, many attorneys and insurance companies use a mathematical formula to estimate the value of an injury, and. Most cases are resolved as claims with the insurance company without the need for any lawsuit or litigation and reaching personal injury settlements. Personal injury settlements are usually negotiated between the client's law firm and the insurance company of the responsible party. Decisions about settlement. Lump-sum payments and structured settlements are the two most common ways personal injury settlements are paid. A lump-sum payment means you get all your. The vast majority of personal injury cases are resolved through a mutual settlement. These settlements could occur early on in the process and conclude without. Personal injury settlements are often advantageous for plaintiffs because they result in faster resolution. During the settlement process, the plaintiff's.

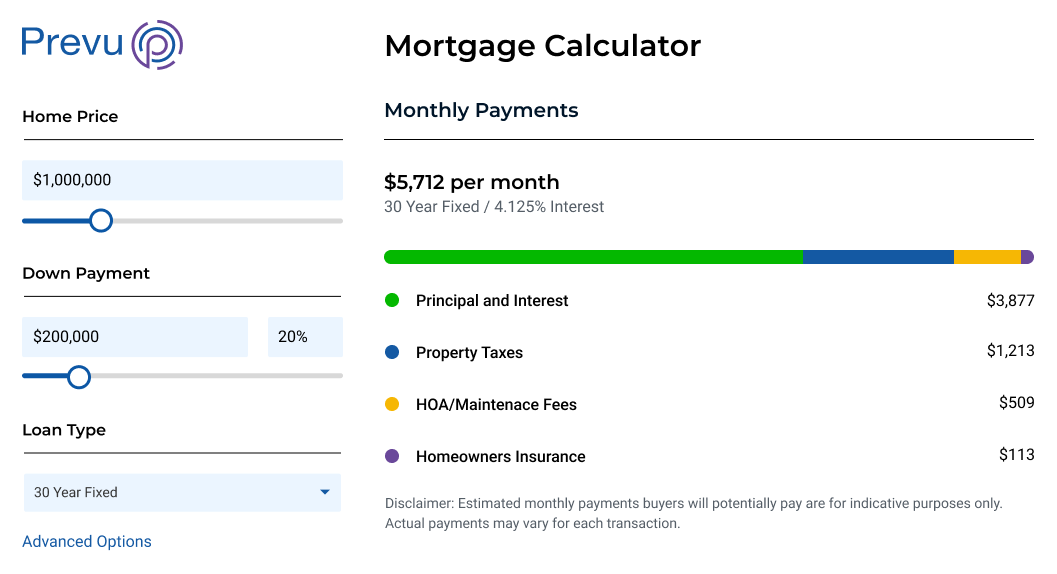

Mortgage Tax Return Calculator

The home mortgage interest deduction (HMID) allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to $, worth of. This calculator estimates your tax savings after a house purchase. Financial analysis is provided for an initial period selected by the user & subsequent years. Find out how much you can save on your taxes as a homeowner with information about your loan, upfront fees, taxes and insurance. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. The home mortgage interest deduction (HMID) allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to $, worth of. Use this Mortgage Interest Tax Deduction Calculator to determine how much you could save in income taxes. Interest paid on a mortgage is tax deductible if you. This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes. The interest paid on a mortgage, along with any points paid at closing, are tax-deductible if you itemize on your tax return. Use this calculator to see how. Interest and points paid for a home mortgage are tax deductible. Use this calculator to determine how much your mortgage could save you in income taxes. The home mortgage interest deduction (HMID) allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to $, worth of. This calculator estimates your tax savings after a house purchase. Financial analysis is provided for an initial period selected by the user & subsequent years. Find out how much you can save on your taxes as a homeowner with information about your loan, upfront fees, taxes and insurance. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. The home mortgage interest deduction (HMID) allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to $, worth of. Use this Mortgage Interest Tax Deduction Calculator to determine how much you could save in income taxes. Interest paid on a mortgage is tax deductible if you. This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes. The interest paid on a mortgage, along with any points paid at closing, are tax-deductible if you itemize on your tax return. Use this calculator to see how. Interest and points paid for a home mortgage are tax deductible. Use this calculator to determine how much your mortgage could save you in income taxes.

If your mortgage closed before December 15th, the mortgage tax deduction is limited to $1,, in mortgage amount. For example, if you take out a. tax-deductible if you itemize on your tax return. Use this calculator to see how this deduction can create a significant tax savings. JavaScript is required. Calculate your potential tax savings with our Mortgage Tax Deduction Calculator. Estimate your deductions and optimize your finances. Try it now! Interest and points paid on a mortgage is tax deductible if you itemize on your tax return. Use this calculator to determine how much you could save in income. This part explains what you can deduct as home mortgage interest. It includes discussions on points and how to report deductible interest on your tax return. It includes discussions on points and how to report deductible interest on your tax return. Generally, home mortgage interest is any interest you pay on a loan. This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes. It includes discussions on points and how to report deductible interest on your tax return. Generally, home mortgage interest is any interest you pay on a loan. Before filing your taxes, use this calculator from Navy Federal Credit Union to see how much your mortgage interest and points paid could save you. Bankrate provides a FREE mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax. UniBank's Mortgage Tax Calculator helps you determine how much your mortgage payments could decrease your income taxes. Find potential tax savings today! Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. A mortgage interest tax calculator is a great place to start when estimating how much you might be able to deduct from your federal and state taxes this year. The interest paid on a mortgage, along with any points paid at closing, are tax-deductible if you itemize on your tax return. Use this calculator to see how. Interest paid on a mortgage is tax deductible if you itemize on your tax return. So are points that are paid to lower your interest rate. Interest paid on a mortgage is tax deductible if you itemize on your tax return. So are points that are paid to lower your interest rate. Use this calculator to. Find out how much you can save on your taxes as a homeowner with information about your loan, upfront fees, taxes and insurance. Interest and points paid for a home mortgage are tax deductible. Use this calculator to determine how much your mortgage could save you in income taxes. Interest paid on a mortgage is tax deductible if you itemize on your tax return. So are points that are paid to lower your interest rate. Mortgages often come with built-in tax deductions. Estimate how those can work in your favor during this year's tax season with ACCESSbank's calculator.

Perks Of Credit Unions

How is a credit union different than a bank? Credit unions are not-for-profit organizations that exist to serve their members. Like banks, credit unions. When your credit union profits, so do you. As a shareholder, you benefit from your credit union's success in the form of lower fees, better interest rates or. They generally allow you to open checking and savings accounts, obtain loans for homes, cars and businesses, and (in Affinity's case) provide credit cards. Credit unions typically offer lower interest rates on loans than traditional banks and high-cost credit providers, many people find using them enables them to. Most credit unions offer the same services and products as banks, such as mortgages, lines of credit, checking and savings accounts, auto loans and the. The NCUA is responsible for regulating federal credit unions, insuring deposits, and protecting members of credit unions. Credit unions are full-service financial co-operatives. Like other financial institutions, we provide chequing and savings accounts, mortgages, business loans. Most credit unions offer the same services and products as banks, such as mortgages, lines of credit, checking and savings accounts, auto loans and the. When you join a credit union, you aren't just an account number. You're joining a not-for-profit financial cooperative where all of the members are owners. How is a credit union different than a bank? Credit unions are not-for-profit organizations that exist to serve their members. Like banks, credit unions. When your credit union profits, so do you. As a shareholder, you benefit from your credit union's success in the form of lower fees, better interest rates or. They generally allow you to open checking and savings accounts, obtain loans for homes, cars and businesses, and (in Affinity's case) provide credit cards. Credit unions typically offer lower interest rates on loans than traditional banks and high-cost credit providers, many people find using them enables them to. Most credit unions offer the same services and products as banks, such as mortgages, lines of credit, checking and savings accounts, auto loans and the. The NCUA is responsible for regulating federal credit unions, insuring deposits, and protecting members of credit unions. Credit unions are full-service financial co-operatives. Like other financial institutions, we provide chequing and savings accounts, mortgages, business loans. Most credit unions offer the same services and products as banks, such as mortgages, lines of credit, checking and savings accounts, auto loans and the. When you join a credit union, you aren't just an account number. You're joining a not-for-profit financial cooperative where all of the members are owners.

Credit unions may be safer than banks in an economic collapse or recession due to taking fewer large risks regarding consumer and commercial loans and investing. What is a Credit Union? · Advantages of Being a Member of Your NC Community Credit Union. After establishing a savings account, membership is granted as long as. Credit Union Advantages: The benefits of Credit Unions · We work for you, not for profit · Be treated like a human, not a credit score · Free financial coaching. Credit union credit cards come with great benefits, including rewards such as cashback options, gift cards, travel, and opportunities to earn double or 3x. Credit union profits are returned back to members in the form of higher savings rates, lower loan rates, and lower fees. Why Do Credit Unions Have Better Interest Rates? · More flexible lending decisions than traditional banks · Personalized member support · Free financial education. Most credit unions offer generous (k) retirement plans with employer match, comprehensive medical plans, life insurance, bereavement leave, and short- and. 1. Lower Fees. Credit unions tend to offer lower fees than banks. This is because of their not-for-profit business structure and their tax-exempt status. Rather. Data on credit union membership benefits for the U.S. and individual states. Ultimately, choosing a credit union to manage your finances lets you take advantage of services that truly help your everyday life. The more control you have. What Are the Major Advantages of Credit Unions? Credit unions typically offer lower closing costs for home mortgage loans, and lower rates for lending. Credit union profits go back to their members, such as offering No-Fee Chequing Accounts. They also invest their profits back into the local community. Bank. Benefits of Joining a Credit Union · Lower Rates · Lower Fees · More Forgiving Qualifications Standards · Community Presence · Higher Rates On Savings Accounts. Credit union credit cards come with great benefits, including rewards such as cashback options, gift cards, travel, and opportunities to earn double or 3x. This means credit union members can use the services of other credit unions for free, all across the U.S. and in a few participating countries. And most credit. 1 - If you switch to a credit union, you pay fewer fees and don't support one of the big banks that almost killed the economy in Upvote. Advantages of Being a Member of Your NC Community Credit Union · Lower Loans & Credit Card Rates · Lower Fees · You're a member not just a customer · Personal. The Unique Benefits of Being A Credit Union Member · credit unions are not-for-profit. · Nomination of Accounts · Loans and Savings Are Insured · Flexibility. CCUA members have access to exclusive industry news, resources, and many other member benefits and services. Join us for CCUA's Financial Forum taking. Why You Should Choose a Credit Union Over a Bank for a Home Equity Loan. Choosing a credit union for your home equity loan often means benefiting from lower.